State-by-State Sales Tax Guide for Services

Local Marketing

Oct 12, 2025

Oct 12, 2025

Navigate the complexities of sales tax for services across different states, ensuring compliance and avoiding costly errors.

Understanding sales tax for services in the U.S. can be tricky. While most states tax goods, services often follow different rules, varying widely by state. Some states, like Delaware, have no sales tax, while others, like Hawaii, tax many services. Missteps in compliance can lead to penalties, so businesses must stay informed, especially if operating across state lines under economic nexus rules.

Key Takeaways:

Economic Nexus: States may require businesses to collect sales tax based on revenue or transaction thresholds, even without a physical presence.

Service Taxability: Services like janitorial work, landscaping, and digital services may be taxed differently depending on the state.

Common Errors: Late registration, misclassifying services, and using outdated tax rates can result in fines.

Tech Solutions: Automated tools help track rates, monitor thresholds, and simplify compliance processes.

For businesses, staying compliant means understanding state-specific rules, monitoring changes, and leveraging tools to manage obligations effectively.

Online Sales Tax: The COMPLETE GUIDE for ecommerce sellers

Economic Nexus and Service Taxability Basics

Economic nexus and service taxability are the guiding principles for determining when and where businesses must collect sales tax. These rules apply whether or not you have a physical presence, like a storefront or office, in a specific state. Let’s break down economic nexus first, followed by how different types of services impact taxability.

What is Economic Nexus

Economic nexus is a legal concept that requires businesses to collect and remit sales tax in a state once their economic activity surpasses certain thresholds - even if they don’t have a physical location there [1][2][3]. This principle gained legal backing after the 2018 U.S. Supreme Court decision in South Dakota v. Wayfair, which allowed states to enforce sales tax collection from remote sellers [1][2][4][5].

Here’s an example: If an Ohio-based landscaping company generates enough revenue from clients in Texas to meet that state’s threshold, it must collect Texas sales tax. This rule applies to all kinds of service providers, such as HVAC contractors, janitorial services, and catering businesses, working across state borders.

States generally define economic nexus thresholds in two ways: annual revenue or number of transactions. Most states set the threshold at $100,000 in annual revenue or 200 separate transactions. Some states use one or both of these criteria.

It’s important to note that the revenue threshold is based on gross receipts, not profit. For instance, if your HVAC business earns $120,000 in service revenue from a state where you don’t have a physical presence, you’ve likely triggered economic nexus obligations there.

These thresholds are typically measured on a calendar year basis, and many states require monthly monitoring of sales. Once you exceed the threshold, you’ll usually need to register for a sales tax permit and start collecting sales tax, often as early as the following month.

Taxable vs. Non-Taxable Services

The taxability of services varies widely by state. While physical goods are generally taxable in most states, services fall into a complex mix of taxable and non-taxable categories, depending on the location.

Labor-intensive and professional services are treated differently. For example, janitorial and cleaning services are taxable in states like Texas and California but may be exempt elsewhere. Similarly, landscaping services might be taxable if they involve installation but exempt if they’re strictly maintenance-related.

Digital services are increasingly falling under sales tax regulations as states adapt to modern business models. Services like web design, software consulting, and digital marketing are now taxable in many jurisdictions, even when provided entirely online.

The distinction between repair services and installation services is another key factor. Many states tax installation or improvement work but exempt basic repairs. For instance, an HVAC contractor replacing an entire system might owe sales tax on the labor, while routine maintenance could be tax-free.

Professional services such as legal advice, accounting, and business consulting are generally exempt from sales tax in most states. However, if these services include tangible deliverables or software components, the tax treatment may change.

Some services occupy gray areas where tax rules depend on specific details. Catering services, for example, might be taxed as food sales in one state and as a service in another. Factors like where the food is consumed, whether it’s prepared on-site or off-site, and whether serving staff is included can all influence the taxability.

Business-to-business services often receive different tax treatment compared to business-to-consumer services. For example, manufacturing support services might qualify for exemptions when provided to other businesses but could be taxable when sold to individual consumers.

The bottom line? Service providers must carefully research the tax rules in every state where they have economic nexus. What’s exempt in your home state might be fully taxable elsewhere, and assuming uniform rules across states can lead to costly compliance errors.

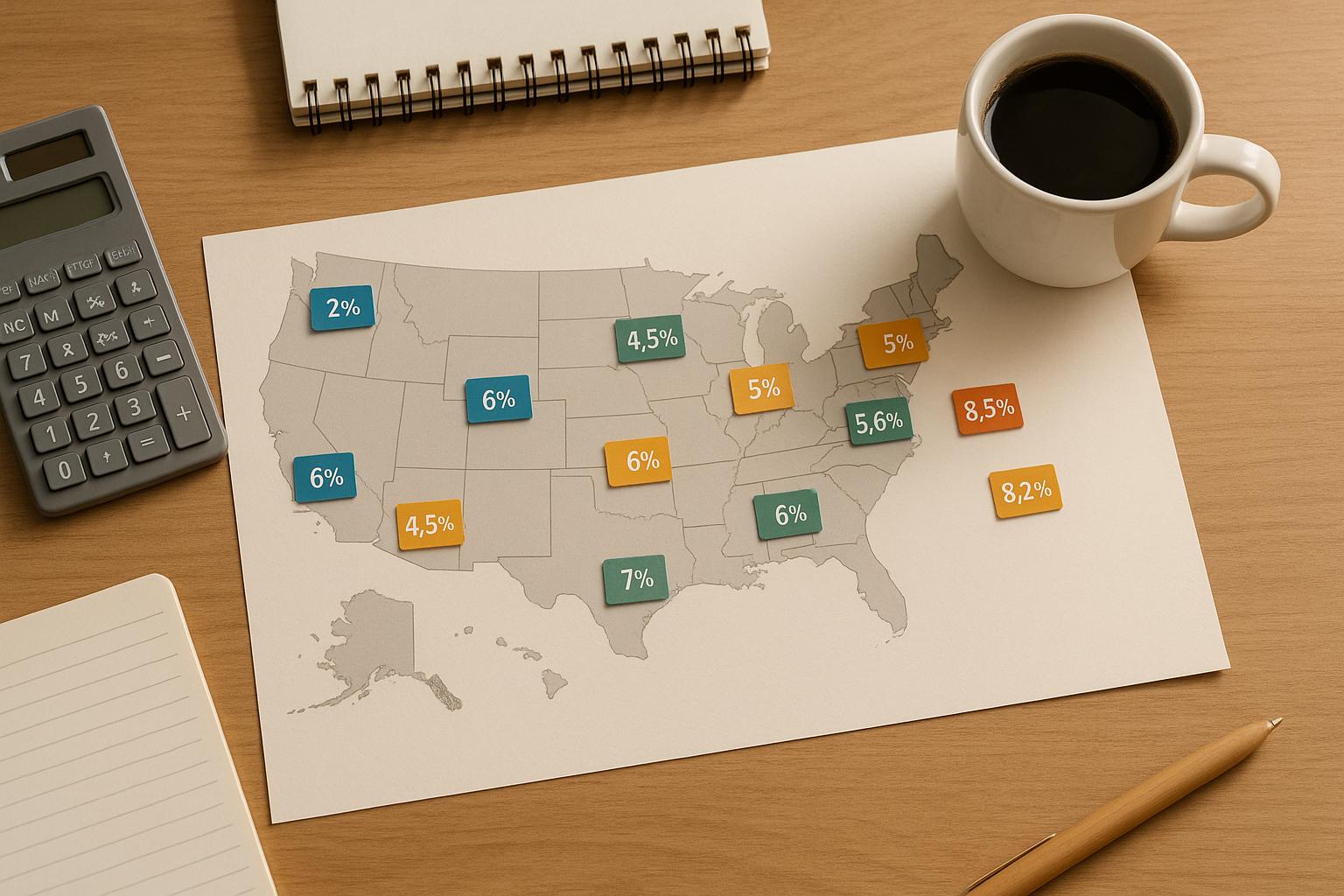

Sales Tax Rules by State for Service Providers

Sales tax regulations can be a maze, with each state setting its own rules, rates, and thresholds. As of October 7, 2025, 45 states and the District of Columbia impose a statewide sales tax with economic nexus rules. However, Delaware, Montana, New Hampshire, and Oregon do not have statewide sales taxes, and Alaska doesn’t impose a statewide tax either - though local jurisdictions in Alaska can set their own tax rates[3][7]. Below is a guide to help you navigate these state-specific tax requirements.

How to Use the State Tax Reference Table

States determine economic nexus thresholds based on either annual revenue, the number of transactions, or both. Here's the breakdown:

Nineteen states rely solely on a dollar threshold.

Twenty-five states allow businesses to qualify based on either a dollar amount or transaction count.

Connecticut and New York stand out by requiring businesses to meet both revenue and transaction criteria[3][7].

It’s also worth noting that states calculate "includable sales" differently. This means service providers need to carefully track both total revenue and transaction numbers to ensure compliance.

When a business surpasses a state's economic nexus threshold, it’s time to act. You’ll need to register with the state’s tax authority, collect the applicable sales tax, and remit it according to the state’s rules. Delaying registration could lead to penalties, so it’s crucial to handle this promptly.

Special State Rules and Exceptions

Some states have taken steps to simplify economic nexus compliance by removing transaction thresholds altogether. For instance:

Alaska eliminated its transaction threshold on January 1, 2025.

Indiana followed suit on January 1, 2024.

North Carolina and Wyoming did the same as of July 1, 2024.

Illinois is set to remove its 200-transaction threshold starting January 1, 2026[5][6][3].

This shift toward dollar-only thresholds can make compliance easier by reducing the need to track multiple metrics.

However, uniformity in sales tax rules is still a pipe dream. What works in one state may not apply in another. To stay compliant as your business grows across state lines, you’ll need to regularly monitor sales activity and stay updated on local tax regulations. These variations underscore the importance of keeping a close eye on tax rules to avoid common compliance pitfalls.

Common Tax Compliance Problems and How to Fix Them

Navigating sales tax compliance can feel like walking through a minefield, especially for service providers. With varying rates, intricate jurisdictions, and ever-changing rules, even small missteps can lead to hefty penalties. Let’s dive into some of the most common pitfalls and how to address them effectively.

Most Common Compliance Mistakes

Late registration is a frequent issue. Many service providers wait too long to register with state tax authorities, often delaying until they exceed nexus thresholds. Unfortunately, this delay can result in penalties and back-tax liabilities - expenses that could have been avoided with timely action.

Misclassifying services is another common problem. For instance, some businesses mistakenly charge tax on services that should be exempt. HVAC contractors, for example, sometimes struggle to determine whether repairs are taxable or if equipment sales should include tax. These errors can lead to overcharging customers or under-collecting taxes, both of which can have financial consequences.

Ignoring dual metrics - like revenue and transaction counts - can leave businesses exposed. Some states consider both metrics when determining nexus, so focusing on just one can lead to unexpected tax obligations.

Rate calculation errors occur when outdated tax rates are used. While a state’s base rate might seem straightforward, additional local taxes can significantly increase the total. Using incorrect rates can result in undercharging or overcharging customers, each with its own set of complications.

Managing exemption certificates is a headache for many. Accepting expired certificates or failing to collect proper documentation from tax-exempt customers can lead to uncollected tax liabilities. In an audit, these oversights often result in penalties and interest charges, adding to the financial burden.

The financial impact of these mistakes can be severe, with penalties and interest compounding quickly if not addressed.

Using Software Tools for Tax Compliance

To tackle these challenges, many service providers are turning to automated tax software. These tools simplify multi-state compliance and help reduce the risk of errors.

Real-time rate updates keep tax calculations accurate by reflecting changes as they happen, so you don’t have to manually track rates across multiple jurisdictions.

Automated nexus monitoring ensures you stay ahead of registration requirements. These systems track sales activity by state and alert you when you’re approaching nexus thresholds, allowing for proactive compliance.

System integration connects tax, accounting, and CRM platforms, minimizing manual data entry errors and streamlining operations.

Local service providers using tools like Cohesive AI can seamlessly integrate automated tax compliance features into their workflows. As businesses expand into new states, these tools help manage evolving tax obligations efficiently, freeing up time to focus on customer service and growth.

Many of these software solutions are priced competitively, offering a cost-effective way to avoid the steep penalties that come with non-compliance. Additionally, automated reporting features simplify the filing process by generating accurate forms ready for submission.

Selecting the right software depends on your business’s size and needs. Smaller operations might benefit from basic features like rate calculation and filing, while larger businesses often require advanced capabilities, such as exemption certificate management and multi-location reporting. The key is finding a solution that aligns with your complexity and growth plans.

How to Collect and Report Sales Tax Properly

Getting sales tax collection and reporting right from the beginning can save your business from expensive mistakes. In 2024 alone, there were over 500 changes to local sales tax rates[10]. This highlights the importance of having a structured plan for managing tax obligations.

Getting Sales Tax Permits in Multiple States

Registering for sales tax permits varies by state, but the process generally requires similar information. You’ll need to provide details about your business, estimated monthly sales, and the services you offer. While some states process applications in just a few days, others may take weeks.

Start the registration process before hitting economic nexus thresholds. Many states mandate registration within 30 days of establishing nexus. Missing this deadline can lead to penalties, even before filing your first return.

To streamline the process, gather all necessary documents in advance. Most states require your Federal Employer Identification Number (EIN), business formation documents, and service details. Having these ready can help avoid delays.

Once you’ve submitted your applications, monitor their progress. Use online portals or contact the relevant authorities directly, and keep records of all correspondence and confirmation numbers in case issues arise.

Be aware of the filing frequency assigned to your business. States often decide whether you’ll file monthly, quarterly, or annually based on your expected tax liability. New businesses are frequently placed on a monthly schedule until they establish a payment history.

After securing your permits, focus on following best practices to ensure accurate tax collection and payment.

Best Practices for Tax Collection and Payment

Keep detailed records of every transaction. This includes customer information, descriptions of services provided, taxes collected, and any exemption certificates. These records are invaluable if your business is audited.

Set up a separate account for collected taxes and consider automating rate calculations. Since this money belongs to the state, keeping it separate reduces the risk of accidentally spending it.

Always file returns on time, even if no tax is owed. Many states require zero returns, and late filings can result in penalties. For example, in New York, filing a return even one month late can lead to a 20% penalty[11].

Use electronic payments whenever possible. Online payment systems offered by most states can speed up processing and improve your documentation.

These practices provide a strong foundation for managing compliance across multiple states.

Keeping Up with Tax Law Changes

Once you’ve established reliable systems for tax collection and payment, it’s crucial to stay updated on changes in tax laws. States, counties, and cities frequently adjust rates, exemptions, and nexus thresholds, making manual tracking a challenge[11].

Subscribe to updates from state tax authorities. Many states offer email alerts for significant changes, providing timely and accurate information.

Joining industry associations can also be helpful. These organizations often summarize tax updates relevant to specific industries, saving you time and effort.

Conduct quarterly compliance reviews to ensure your registrations, tax rates, and nexus obligations are up to date. Businesses filing in multiple states can spend up to 69 hours a month on manual filing and remittance, so these reviews can also identify areas where automation could save time[8].

Consider using technology solutions that monitor tax rate changes and adjust calculations automatically. These tools are especially useful as your business grows and enters new markets.

For service businesses that use platforms like Cohesive AI to target local markets, managing multi-state tax obligations becomes even more important. As your campaigns expand across state lines, having reliable systems in place ensures compliance while supporting growth.

Finally, document your compliance procedures thoroughly. Clear instructions help your team stay consistent and reduce errors. Written procedures also make transitions smoother and demonstrate good-faith efforts if your compliance is ever questioned.

Investing in proper systems and automation pays off in the long run. Financial professionals who rely on automation report being 64% more confident in their compliance processes compared to those managing it manually[8].

Conclusion

Keeping up with sales tax compliance for services has become more challenging as states expand their taxation of digital services. For example, Washington State will begin taxing advertising and IT services on October 1, 2025, and Maryland's 3% tax on IT and data services takes effect on July 1, 2025. These changes highlight how quickly the regulatory environment is shifting[12][9]. Staying compliant is no longer optional - it's a necessity.

Adding to the challenge are the variations in tax rules from state to state, which make manual compliance nearly impossible for businesses looking to grow. The regulatory landscape continues to evolve, with some states introducing new exemptions, like Florida, while others, such as Utah, eliminate thresholds altogether. This patchwork of rules demands constant attention and adaptation[9].

Technology has become a crucial tool in navigating these complexities. Automated platforms can track frequent rate changes and ensure accurate tax collection across multiple states[13][9]. For businesses expanding into new markets - especially those using tools like Cohesive AI - reliable tax compliance systems are essential. As operations span across state lines, these systems help simplify an otherwise overwhelming process, aligning with earlier recommendations to leverage automation for compliance.

The stakes are high. With sales tax rates ranging from 0% in states like Oregon to over 11% in certain localities, the financial risks of non-compliance can be severe[14][15][16]. Proactive planning and automated solutions not only help you avoid costly mistakes but also allow you to focus on growing your business.

FAQs

How can businesses know if they need to collect sales tax in states where they don’t have a physical location?

Businesses can figure out if they’re required to collect sales tax in states where they don’t have a physical presence by reviewing the economic nexus thresholds defined by each state. These thresholds typically depend on either a specific amount of sales revenue (like $100,000 in gross sales) or a set number of transactions (such as 200 within a 12-month period).

Keeping a close eye on sales and transaction numbers in every state is crucial for staying compliant with tax regulations, especially after the 2018 South Dakota v. Wayfair decision. Monitoring these metrics regularly can help businesses steer clear of penalties and ensure they’re meeting their tax responsibilities.

What are some common mistakes when classifying services for sales tax, and how can businesses ensure compliance?

Misclassifying services for sales tax is a common challenge, particularly when dealing with professional services like legal, medical, or consulting work. Whether these services are taxable or exempt often depends on the specific rules of each state, making it easy to slip up.

To avoid these pitfalls, businesses need to stay up-to-date with state-specific tax regulations, properly classify their services, and keep thorough records. Reaching out to state tax authorities or leveraging tax automation tools can make the process more manageable and help prevent expensive errors. Regularly reviewing your tax responsibilities is key to staying on the right side of compliance.

What are the advantages of using automated tax software for managing sales tax across multiple states, and how can it help prevent common compliance errors?

Automated tax software takes the headache out of multi-state sales tax compliance by calculating tax rates with precision across different jurisdictions. It ensures businesses consistently apply the right rates, which is crucial when dealing with the maze of varying tax rules.

This software doesn't just handle calculations - it automates key tasks like tracking filing deadlines and analyzing tax data. The result? Businesses save time, reduce manual errors, and steer clear of penalties for late filings or inaccuracies. Plus, it helps companies stay audit-ready by spotting potential issues early, making it an indispensable tool for managing multi-state tax obligations with ease.